Deploying Agentic AI Without Replacing Core Banking Systems

Most financial institutions want smarter automation. They want AI that can reduce manual work, respond in real time, and help customers get things done faster. But they also sit on core systems that have been running reliably for decades. These core systems are responsible for moving money which means that these systems can't afford surprises.

So the question banks are actually asking isn't "How do we deploy AI?"

It's "How do we do it without breaking what already works?"

That tension is why so many AI initiatives stall. Not because the technology isn't powerful, but because deploying it safely inside banking infrastructure is genuinely hard.

Why AI and Core Banking Don't Naturally Fit Together

Core banking systems were designed for certainty. They follow fixed rules and execute predefined workflows. Many still operate in batches, processing requests in predictable cycles. Transitioning to a different core is costly, risky and difficult and you shouldn't have to move for the next generation of experience.

This is why Agentic Banking demands something very different.

An AI agent works in real time and listens for intent, reasons through context, checks constraints, and decides what to do next. It's flexible by nature and that flexibility is what makes it useful but it's also what makes it dangerous if left unchecked.

When banks try to connect these two worlds directly, things start to break down fast.

Scripts that seemed fine at first become brittle. Bots can repeat steps, but they fall apart the moment context shifts. APIs end up getting patched and repatched just to handle edge cases. And each workaround quietly adds more complexity, more fragility, and more risk.

The issue isn't that core systems are outdated. It's that they were never designed to host AI reasoning logic.

What "Agentic" Actually Changes

Traditional automation only acts when told exactly what to do.

Agentic Banking starts with intent.

A customer doesn't say, "Initiate transfer type X from account Y." They say, "Pay my rent," or "Send my nanny $500".

To act safely, an agent has to interpret that request, understand what it implies, and decide whether it's allowed before doing anything at all.

That requires the system to:

- Understand the goal behind the request

- Compare it against policies, limits, and permissions

- Decide whether to act, escalate, or stop

- Record how that decision was made

This is not just automation at higher speed. It's judgment and judgment is exactly what legacy systems were never meant to provide.

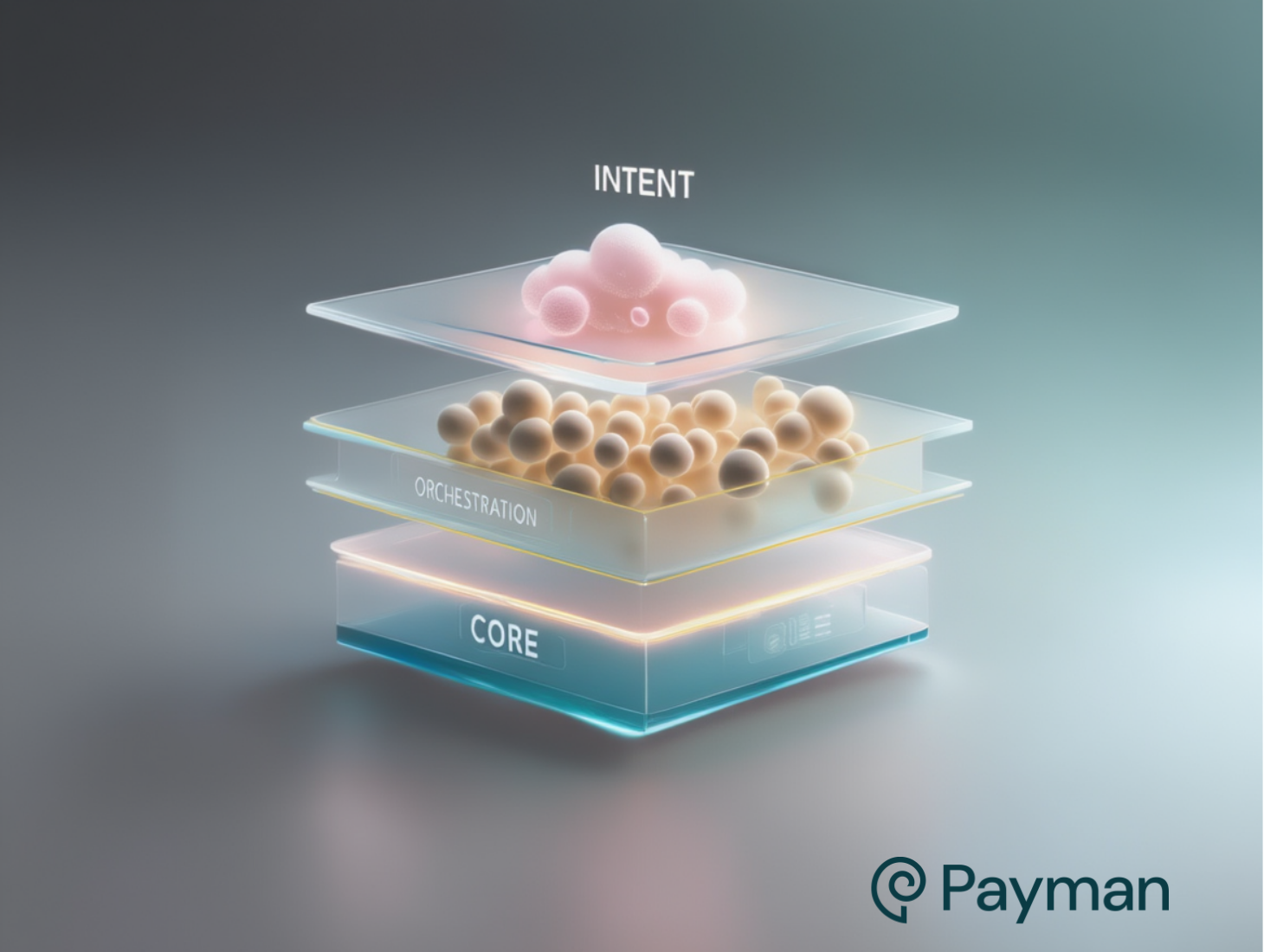

Why Orchestration Becomes the Missing Layer

This is where I have seen many deployments go wrong.

Banks try to embed intelligence directly into existing systems, or bolt AI logic onto fragile workflows. That puts decision-making in places that were built only to execute.

Orchestration changes the model.

Instead of forcing intelligence into the core, orchestration sits above it. It becomes the layer that understands intent, enforces rules, and controls how actions flow across systems.

When an AI agent receives a request, orchestration:

- Translates intent into structured actions

- Checks policies, permissions, and thresholds

- Coordinates across existing systems and rails

- Logs every step for compliance and review

The core system never loses control as it executes deterministically. Simply put the AI never acts unchecked and every decision passes through a governed path.

This separation is what makes Agentic AI deployable in real banking environments.

Safety Without Starting Over

Most banks don't need to rebuild their infrastructure to support AI. They need better control surfaces around it.

That means defining clear boundaries:

- What actions an agent can take on its own

- When approvals are required

- What triggers escalation instead of execution

In practice, this looks like policy driven access. For examples this could include spend limits, transaction thresholds, and approval workflows. All enforced before anything reaches the core.

AI gains room to act, but only within constraints the bank defines. Flexibility increases without sacrificing predictability.

This is how banks move forward without pausing operations or introducing unacceptable risk.

What Smart AI Infrastructure Looks Like Going Forward

As expectations rise, banks are under pressure from customers and regulators. Customers want faster, more natural interactions. Regulators want stronger controls and clearer auditability.

The institutions that succeed won't be the ones that chase novelty. They'll be the ones that add intelligence deliberately.

That means investing in:

- Systems where AI actions can be supervised or paused

- Policy first execution rather than hard coded automation

- Clear, real time audit trails that explain every decision

The goal isn't to make AI more powerful. It's to make it trustworthy.