If you've read our breakdown of what agentic banking is, you already know the concept. AI that doesn't just answer questions about your money, but actually moves it. A customer says "Move $500 from savings to checking," the AI checks it against the bank's rules, and the transaction goes through. One conversation, one outcome.

So the natural follow-up is: why now? AI has been in banking for years. Chatbots have been around for a decade. What actually changed?

Four things are converging at the same time. Any one of them alone would matter. Together, they make agentic banking feel less like a trend and more like an inevitability.

1. Customers Stopped Asking for Better Tools. They Started Expecting Outcomes.

Something shifted in the last two years. It used to be enough to hand someone a well-designed app with the right buttons. Now they talk to their phone and expect it to handle things. They tell Alexa to reorder groceries. They ask ChatGPT to plan a trip. They watch AI agents book flights and compare insurance quotes in a single conversation.

That expectation doesn't turn off when someone opens their banking app. 71% of consumers say they'd welcome an AI assistant in their primary bank's mobile app (Accenture, 2026). Not a chatbot. Not a search bar. Something that actually does things for them.

This isn't customers requesting a feature. It's a behavioral expectation being shaped by every other AI interaction they have throughout their day—and it's moving fast: 50% say they'd switch providers for a better digital experience, and 31% already have (Alkami, 2025).

2. The Money Moved from Experimentation to Execution

For a long time, AI in banking meant pilot programs. Small teams testing chatbots. Proofs of concept that never quite made it to production. Everyone waiting for someone else to go first. That phase is over.

NVIDIA's 2026 State of AI in Financial Services survey tells the story pretty clearly: 21% of financial institutions have already deployed AI agents in production. Another 22% are deploying within the year. Nearly every respondent said their AI budget would increase or hold steady. The question isn't "should we invest?" anymore. It's "how fast can we scale?"

Early results are backing it up—89% of financial services firms say AI is already increasing revenue. Goldman Sachs brought in Anthropic's Claude to handle accounting and compliance. Wall Street banks are telling their teams to lean on AI instead of hiring. The boardroom conversation flipped from "justify this AI spend" to "justify why you haven't deployed yet."

3. The Big Banks Moved. Your Customers Noticed.

Bank of America spent roughly $13 billion on technology in 2025 and is bumping that up another 10% this year (Business Insider, 2026). Erica, their AI assistant, has handled over 3 billion customer interactions. JPMorgan has thousands of AI use cases running in production. These aren't pilots. This is how they operate now.

Here's why that matters for community banks: it's not the spending gap that hurts you. It's the expectation gap. Every time a customer interacts with a megabank's AI, that becomes their new normal. Then they come back to your app, your phone tree, your static interface—and the contrast is immediate. And it compounds: the longer the gap exists, the more normal the better experience feels and the more frustrating yours becomes.

85% of banking leaders agree that institutions adopting AI will gain a significant competitive advantage (CSI, 2026). But that advantage doesn't go to the biggest budget. It goes to whoever deploys first in their market.

4. The Cost of Waiting Started Compounding

Deploying first matters here in a way it doesn't with most banking technology. Core system migrations take 18 months whether you start this year or next. The gap stays roughly the same—you can catch up.

AI doesn't work that way. The cost of waiting compounds, and it does so on three fronts.

First, once someone experiences banking that actually does what they ask in a conversation, they don't go back to navigating menus. That's the new baseline, and your institution gets measured against it whether you're ready or not.

Second, early deployers collect intent data that late movers never will. When customers bank through conversation, they tell you things no transaction record captures. "I'm saving for a house" is a mortgage lead 12 months before any application. "Make sure I don't miss rent again" is a retention signal and a product opportunity in the same sentence. That data builds a compounding advantage in cross-sell and relationship depth. You can't replicate it by deploying the same technology later.

Third, the customers who leave don't come back. Millennials are 3x more likely than boomers to bank with fintechs (Drive Research, 2025). Once they've built their financial life somewhere else, the cost to win them back is dramatically higher than what it would have taken to keep them.

27% of community bank leaders now rank AI readiness as their number one technology concern, up 17 points from last year (CSI, 2026). The urgency is real—but urgency without action is just awareness.

The Window

Any one of these would be worth paying attention to on its own. Customer expectations shifted. The money moved from pilots to production. The big banks set a new bar. And the cost of sitting it out is compounding.

All four are happening at the same time. That's what makes 2026 different. The pieces that were missing are in place now. The question for every bank executive isn't whether agentic banking will happen—it's whether your institution will be one of the ones that shaped it, or one of the ones that reacted to it.

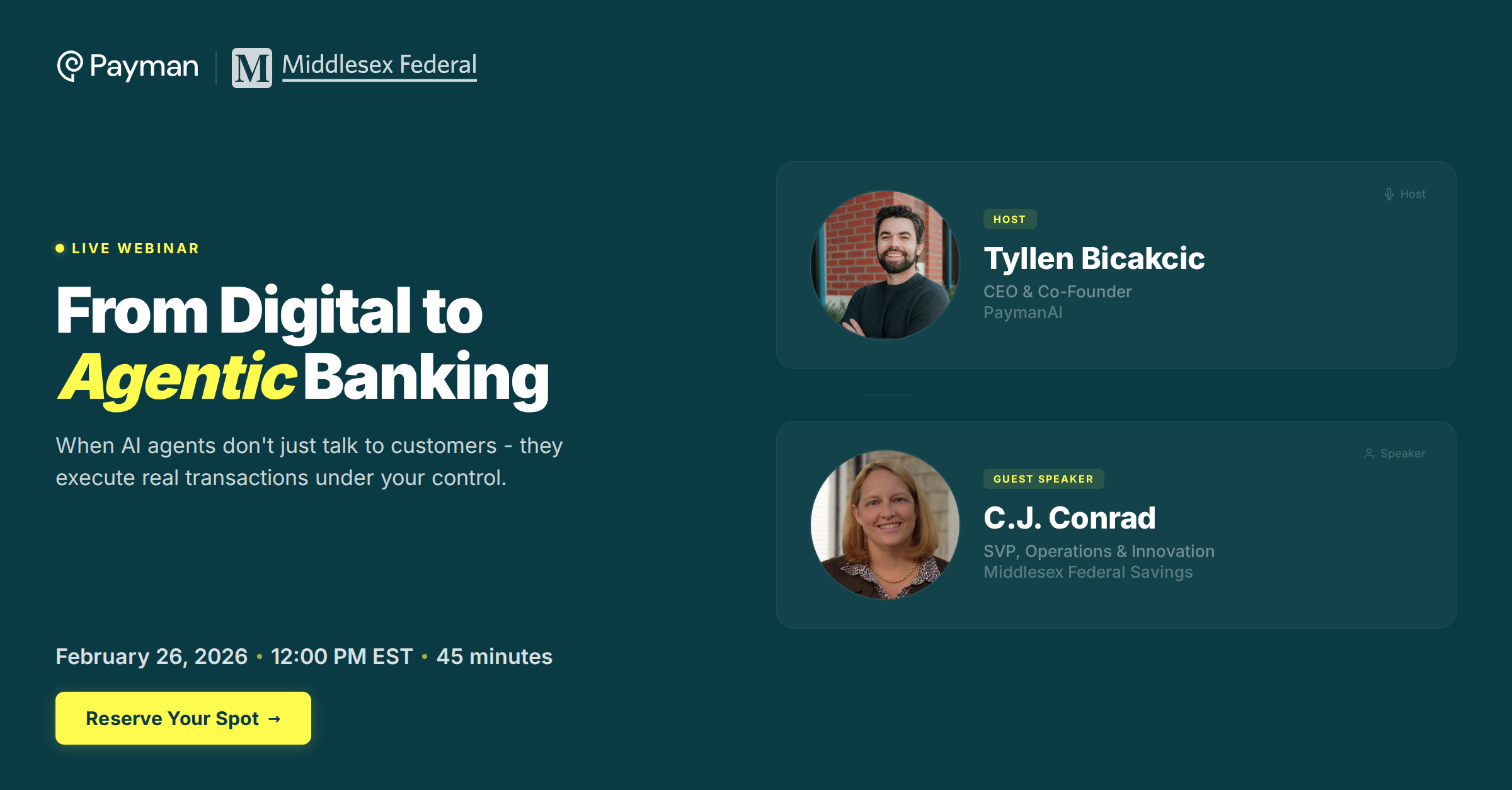

See what agentic banking looks like in practice and watch the demo.