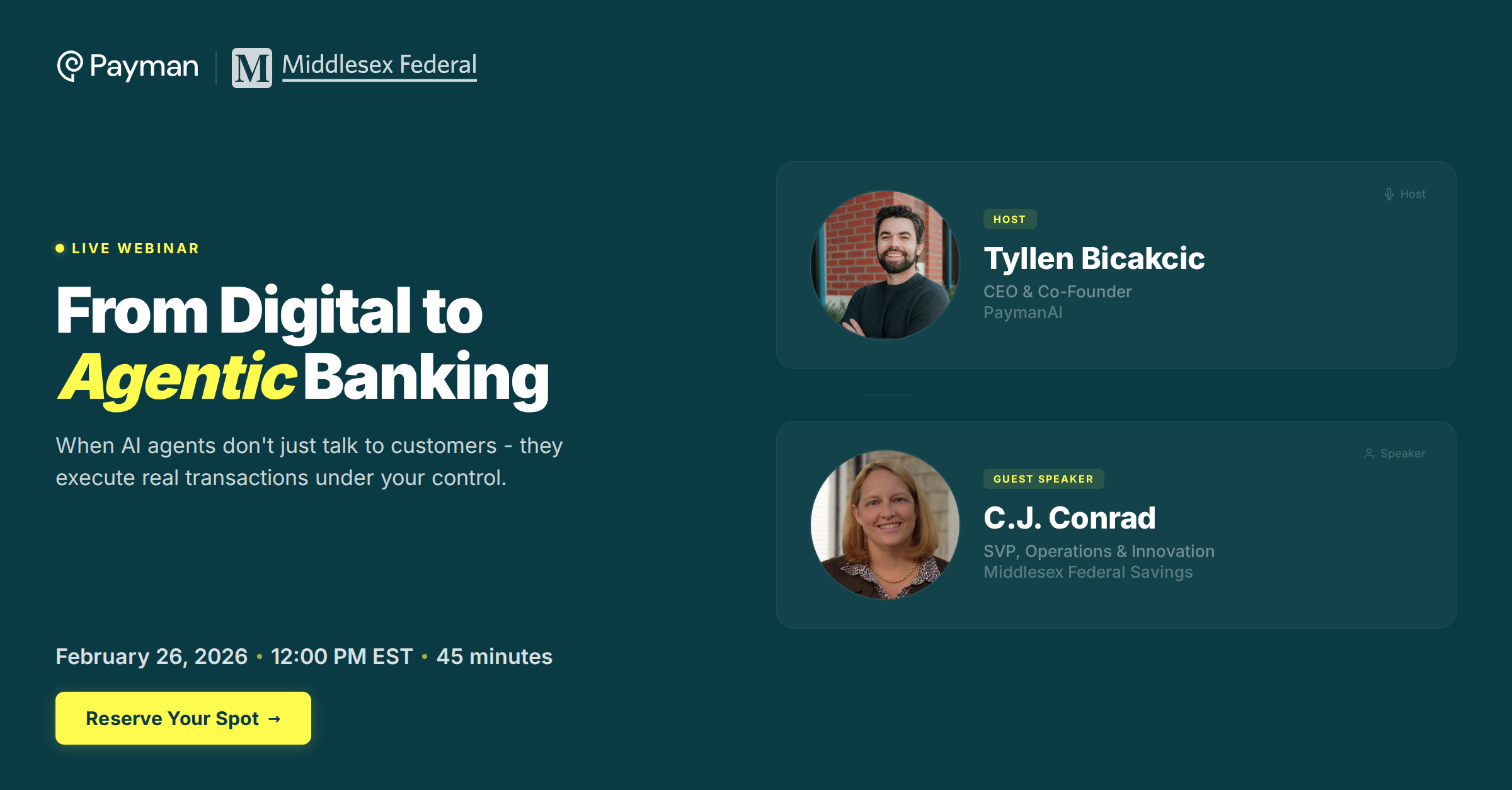

Agentic Banking Guide

Executive Summary

Your customers are already talking to AI about their money. Whose AI?

Fintechs are building AI-native banking from scratch. Big Tech already has the infrastructure. Traditional banks have 18 months before "just ask" becomes the expected banking experience.

Download the guide that shows you how to deploy first.

What Is Agentic Banking?

Agentic banking is AI that executes transactions, not just answers questions. Customers say "pay my rent" and money moves. "Move money from my savings to my checking so I don't get an overdraft fee" happens instantly. No forms. No clicks.

This isn't conversational AI. Chatbots check balances or explain fees. Agentic banking validates payees, checks cash flow, and executes payments in one interaction.

The difference matters because customer expectations have shifted. They interact with AI daily and expect it to do things, not just say things.

What You'll Learn

Why most AI banking pilots fail

AI is probabilistic. Banking is deterministic. We break down the technical gap that kills deployments and the three layer architecture that closes it.

The four risks regulators will ask about

Prompt injection. Hallucinated transactions. Policy drift. Audit failure. How each happens and the only architectural defense that works.

What it actually takes to deploy

Build internally ($10M+, 24 months), wait for your core provider (too late), or deploy purpose-built infrastructure (the path forward).

Why timing matters now

The banks that deploy agentic banking first will define the category. Late movers get commodity features without differentiation.

Built for bank executives navigating the shift from conversational AI to transactional AI.