Good Banking Apps Should Help You Get On With Your Day

When people open a banking app, they're not browsing. They're trying to do something like move money, pay a bill, or check that a payment actually went through. The user is trying to fix something before it turns into a bigger problem.

Maybe it's late December and you're traveling, your phone battery is low, and rent is due in a few days. You open your bank app just to make sure the payment is set and that everything's covered.

If it works, you close the app and move on. If it doesn't, stress shows up immediately. That's why trust matters so much in banking. Not in an abstract way but in a very practical one.

Around this time of year financial tasks fall heavier. There is less time, less patience and more riding on things working the first time. In moments like that, banking tools either make life easier or add to the chaos.

The difference usually comes down to one question: did the system help me finish what I came here to do?

Start With the Task, Not the Screens

In that moment, you don't want to explore menus or figure out where rent payments live in the app. You just want to confirm it's handled.

Good banking experiences start with that task in mind. If you pay rent the same way every month, the system shouldn't make you start from scratch. It should recognize the pattern and make the next step obvious.

When the banking app ask you to tap through extra screens or reread options you already understand, they slow you down. That friction is especially noticeable when you're standing in an airport line or juggling holiday plans.

The best systems don't make a big deal out of routine actions. They make common things feel common (we know, such a novel idea). When that happens, banking fades into the background, which is exactly where users want it.

Trust Comes From Things Behaving the Same Way Every Time

Now imagine you go ahead and schedule the rent payment. Everything looks normal, until the system pauses and asks for confirmation.

That moment can go two ways.

If there's no explanation, it's unsettling. Did something go wrong? Did you mistype the amount? Is this going to bounce?

But if the app tells you, in plain language, that this payment is higher than usual or that it's coming from a different account, the pause makes sense. You feel like the system is looking out for you, not blocking you for no reason.

Security is expected but what builds confidence is predictability and clarity. When the same actions behave the same way every time, people trust the outcome. When something changes, they want to know why and that is human nature.

From the outside, this doesn't feel like a "security feature." It feels like the bank paying attention.

Banking Works Better When It Remembers

Part of what makes that experience feel smooth is memory.

The system knows who your landlord is, it knows what the payment amount and it knows when rent goes out each month.

Because of that context, it can tell the difference between a normal transaction and something that deserves a second look. It doesn't need to interrupt the user every time. It only steps in when something feels off.

This is the kind of memory people actually appreciate. Not reminders for everything, not constant nudges, just enough awareness to be helpful.

When banking systems remember the right things, they stop feeling rigid. They start feeling like they understand how the users financial life actually works.

Trust Is Built in Small, Ordinary Moments

Most people won't remember the design of their bank app. But they will remember moments like this.

Rent went through without stress. A pause was explained clearly. A question was answered quickly. Nothing turned into a problem.

Especially during high-pressure times like the holidays, those small wins matter. They're what make people feel confident that their bank has things under control.

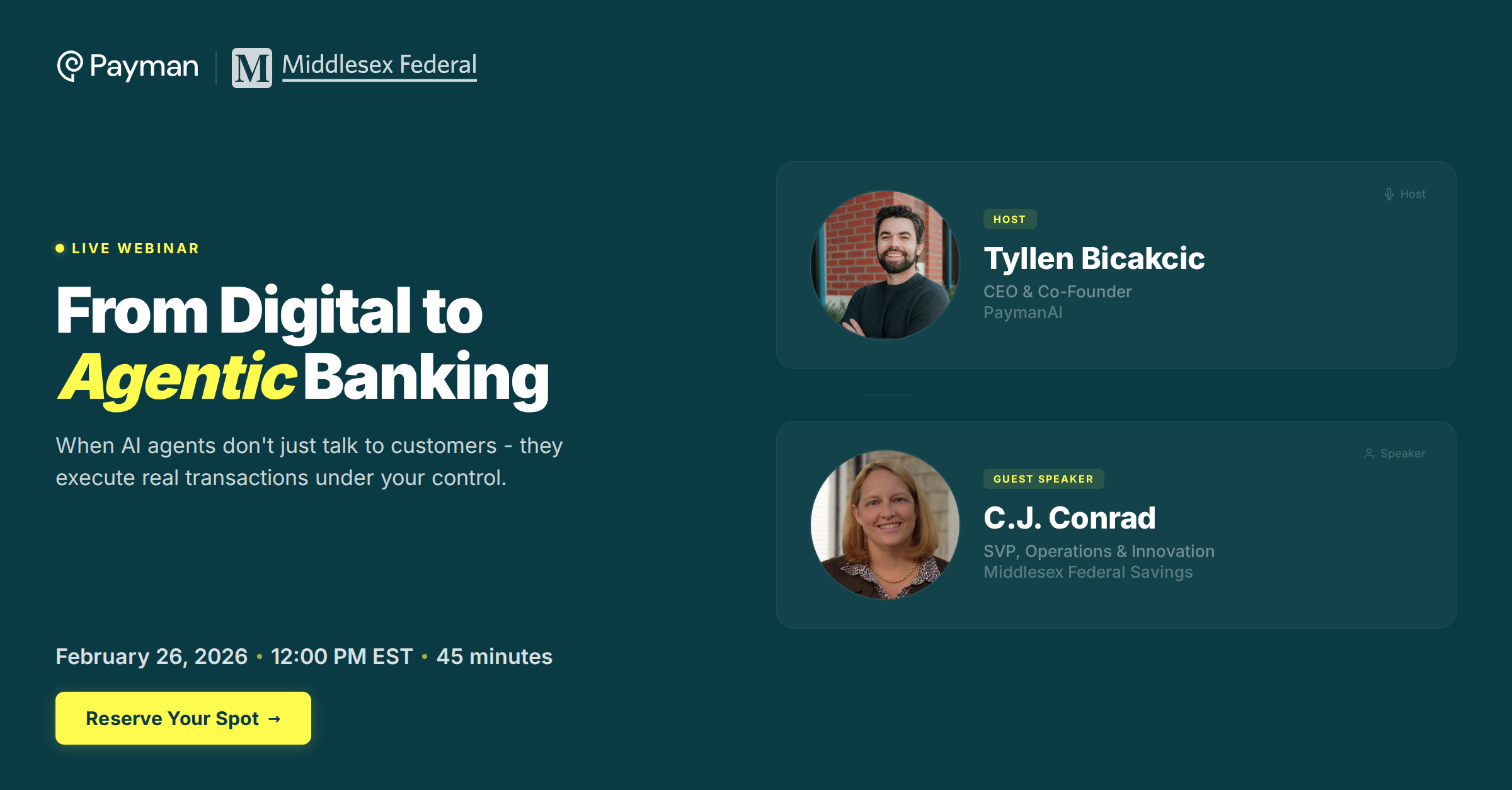

At Payman AI, we focus on the systems behind those moments. Infrastructure that helps banks understand what customers are trying to do, apply the right safeguards, and act clearly. As expectations continue to rise, approaches like Agentic Banking help turn intent into safe, predictable action.

When banking works this way, it feels calm. It feels reliable. And most of the time, users don't think about it at all which is exactly the point.